Why Are Your Funds Safe?

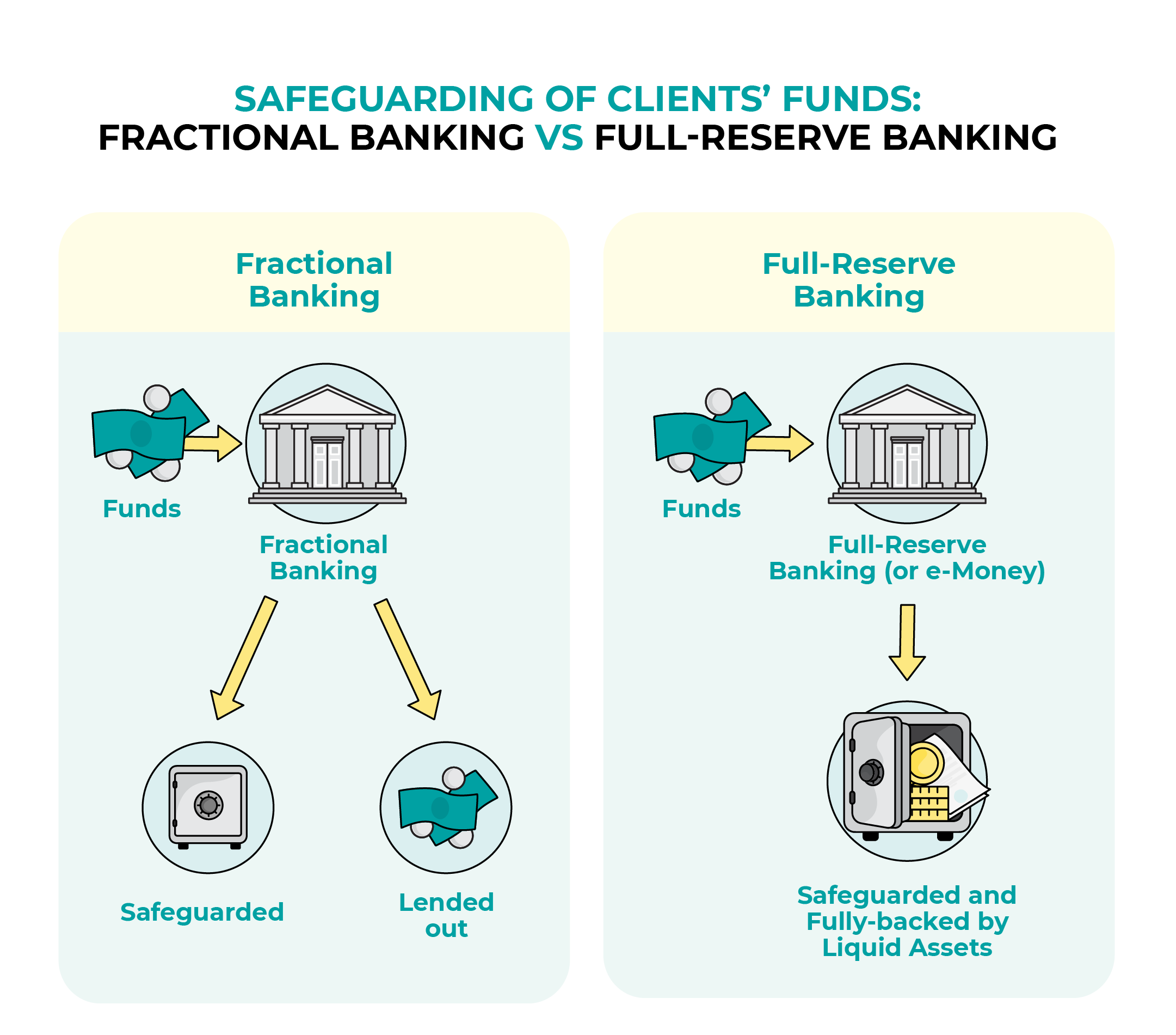

During turbulent times, like the ones we are facing now, one of the main concerns for the public is the safety of their funds kept at financial institutions. While the traditional fractional reserve banking concept is familiar for most of the retail users, its alternative, the full-reserve banking model, is less common in practice. Nevertheless, some economists, especially ones from the Austrian school, have endorsed the full-reserve banking system during a crisis. For example, Nobel prize laureate Milton Friedman has advocated that current accounts should follow the full-reserve requirement (Friedman, 1959).

Funds in Bankera are electronic money, and this setup has similarities to the full-reserve banking, which can be an attractive alternative for traditional bank accounts in uncertain times. In this blog post, we would like to delve deeper and explain how this model works.

What is electronic money?

In practice, electronic money or e-money is simply an electronic representation of fiat money used to back it. Every time electronic money is issued, the same amount of funds is put aside and safeguarded by the electronic money institution (EMI). This helps to ensure that the institution is able to pay back its clients when they want to withdraw funds from the account (or legally redeem their electronic money). As clients’ funds backing electronic money have to be safeguarded and protected, they can only be kept in the form of cash, its equivalents (short-term deposits at banks and the central bank) or highly liquid bonds.

Your money in Bankera wallet is electronic money as Bankera platform is managed by Era Finance Ltd., offering the services as authorised agent of UAB Pervesk, a company holding an Electronic Money Institution license and supervised by the Bank of Lithuania. Hence, the funds are protected by the above-mentioned requirements.

Let’s take a look at several cases that demonstrate how full-reserve and fractional reserve banking differ from the client’s perspective.

Case #1: What happens if all clients want to take their money back?

A case when a large number of clients withdraw money from a bank is also known as a bank run.

Fractional reserve banking in case of a bank run

Fractional reserve banks are at risk of a bank run as they do not have client funds ready for withdrawal. However, if the bank’s loans portfolio is in good condition (most of the loans are being paid in time, etc.), the central bank will act as a lender of the last resort and loan money to the bank to maintain its liquidity.

However, it is not always a case, especially during a financial crisis. In times of a crisis, banks operating in a fractional reserve system are not able to pay back their clients as money is already loaned out. Even if all of its issued loans are in good condition, it would still take time until they are paid back, so the bank would be facing a liquidity crisis and clients would not be able to withdraw their funds. That is one of the most common reasons why banks go bust and are relying on government support or even bailouts.

Full-reserve banking or electronic money in case of a bank run

In full-reserve banking, clients’ funds are not loaned out. The money is safeguarded and kept in very liquid assets such as cash or its equivalents. Hence, in case of a bank run, all clients would be able to withdraw their funds.

Case #2: What happens if a financial institution decides to shut down?

Fractional reserve banking in case of a shutdown

In fractional reserve banking, clients might face difficulty to receive their funds back in a short period of time or might never get back the full amount due to the fact their funds are loaned out. In case of closure, they could only get their money back once loans are paid back or bought by someone else (for example, another bank). In some jurisdictions, clients can be protected by deposit insurance schemes. However, they only cover deposits of a particular amount.

Full-reserve banking in case of a shutdown

In full-reserve banking, clients would still be able to get their money back until the last cent — it would eventually leave the financial institution empty and ready to close. It is important to know, especially in the case of an electronic money institution, that even if it has to close due to being unable to pay its bills, clients funds are still protected and can never be touched. Electronic money issuers are not allowed to use customers’ funds for their own needs. Hence, clients’ funds are segregated from the financial institutions own funds.

We hope that this blog post was useful to understand the concept of electronic money and electronic money institutions. However, if you have further questions or would like to learn about another topic, please contact us via Live Chat. We will be happy to answer all of your inquiries, or we might even cover your suggested topic in a blog post.

References

Friedman, M. (1959), A Program for Monetary Stability, New York, Fordham University Press.

7 April, 2020