Interchange fee explained

When a shop or another merchant accepts a card payment, they usually pay a fee to the acquirer, for example, a bank providing a point-of-sale terminal or online gateway to accept card payments. A part of this fee goes back to the card issuer (bank or another financial institution). This part paid to the card issuer is known as an interchange fee.

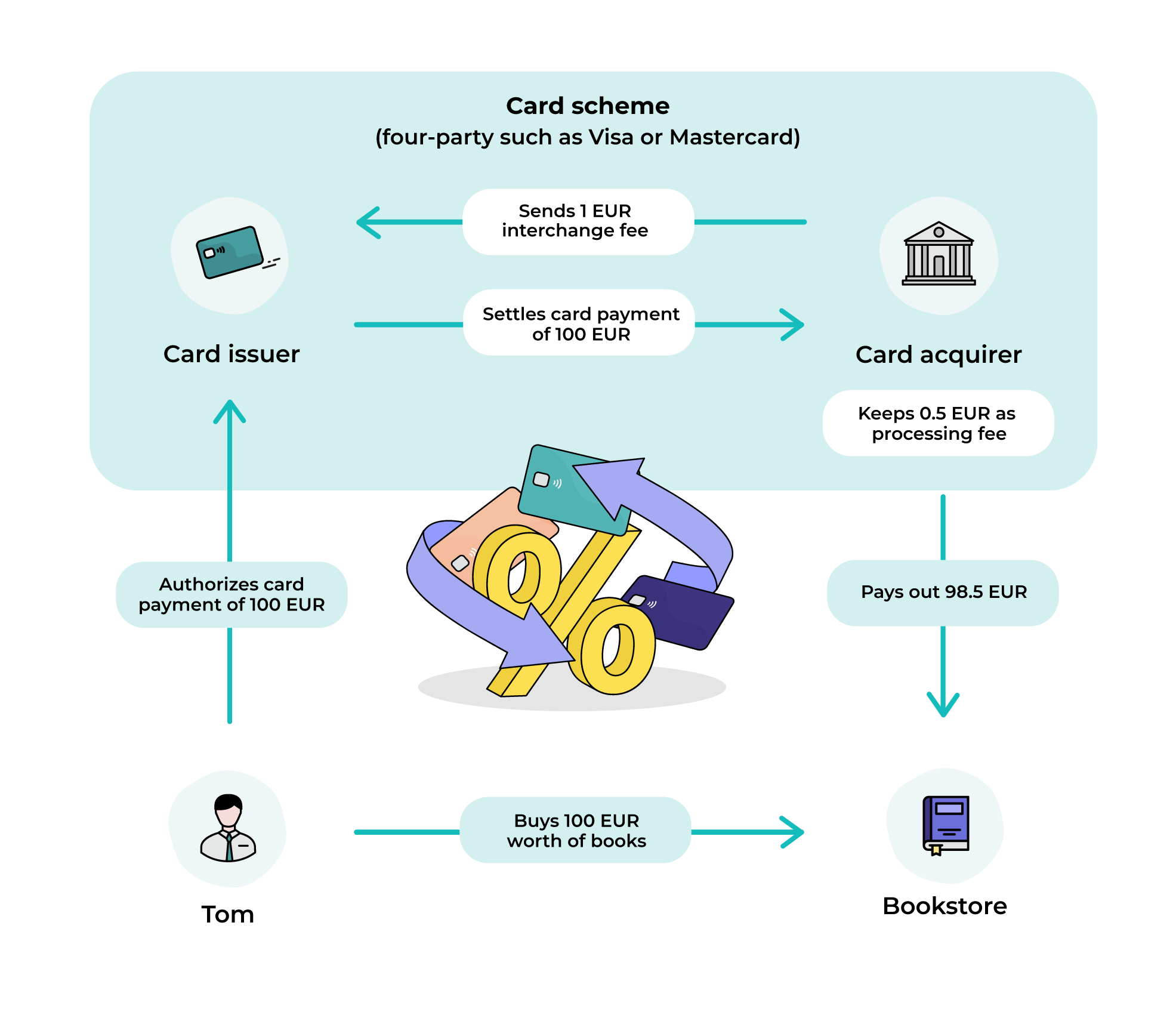

To better understand the logic of the interchange fee, it is helpful to get familiar with the whole cycle of card payments. Most cards operate in so-called four-party schemes (also known as four corners schemes). Visa and Mastercard are the best-known examples of four-party card schemes. Four parties included in this scheme are a cardholder (payer), a merchant, an issuer, and an acquirer.

For example, Tom (a cardholder) is paying 100 EUR at a bookstore (a merchant) via card. The bookstore pays an acquiring fee of 1.5 EUR (1.5%) to its acquiring bank (the one proving the machine or software to accept card payments) and keeps 98.5 EUR. Then the acquiring bank keeps 0.5 EUR (0.5%) as a processing fee and reimburses 1 EUR (1%) back to the issuer as an interchange fee.

It is also worth mentioning that three-party card schemes also exist. In these schemes, the same entity is both the issuer and the acquirer of cards in the market. Hence, card payments are cleared internally.

The interchange fees in the example are illustrative as they depend on the location of the issuer and acquirer. For instance, due to European Union regulation, interchange fees for personal cards in European Union are capped at 0.2%-0.3%. At the same time, the interchange fee for business cards is around 1.3% and can, in some rare cases, reach more than 2%.

Some challenger banks base their business models on the interchange fee as a revenue stream. Other card issuers, for example, cryptocurrency exchanges, are giving part of the interchange fee as a cashback. In such a way, they incentivize users to use their cards and services.

We at Bankera have decided to donate a part of the interchange fee received from every SEPA Instant and Bankera business cards transaction to Ukraine’s resistance. You can read more about our initiative to support Ukraine in our blog post here.

5 August, 2022