Bankera Is Live: Open Your New Bank Account Alternative Today

In 2017 we presented our vision to build a financial institution for the emerging digital economy. Finally, we are excited to announce that our vision moved to the production stage as we have launched the initial version of Bankera internet banking to offer payment accounts with dedicated IBANs and SEPA transfers. We reveal more about the new product in our blog post.

Your New Alternative to Traditional Bank Accounts

While the number of entrepreneurs and businesses in the online industry is growing faster than ever, the sector is still largely underserved and misconceived by conservative financial institutions, mainly due to its novelty and unique specifics. Bankera, however, aims to address the need-gap and provide a banking alternative to those involved in the digital business. At Bankera, clients are welcome to receive funds from cryptocurrency exchanges, affiliate programs or route their income from their commercial online activity.

The initial version of Bankera includes all the essential features of an online banking account. At this point, individual clients can open dedicated European IBAN accounts and take advantage of our SEPA transfers scheme. The platform is also scheduled to provide services for business clients in the upcoming weeks.

Your funds are safe with us

We believe that one of the core deterrents for the broader public to switch to alternative financial solutions from legacy banks comes down to trust. At large, while people do not trust legacy banks to give them the best value for their money, they do still trust the established banks to keep their funds safe.

As Bankera wallet platform (managed by Era Finance Ltd) is offering the services as authorised agent of UAB Pervesk, a company holding an Electronic Money Institution license and supervised by the Bank of Lithuania, 100% of clients funds are segregated and not a cent is loaned out as in a traditional bank. This model is very similar to full-reserve banking, which could offer an additional layer of security in such turbulent times.

We have your back

While we built Bankera e-wallet for a seamless experience, we understand that in daily financial operations, questions or unexpected issues might pop up and every second matters. That is why we made sure Bankera service has 24/7 live support that is ready to help you. Just reach out to our friendly support team via Live Chat or by filling out the helpdesk form on our landing page.

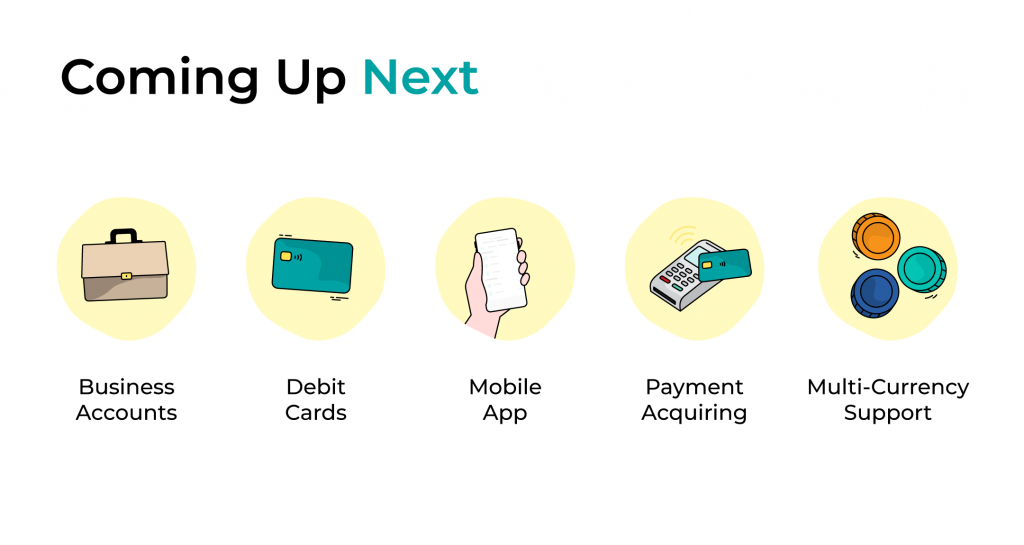

Coming up next

The current state of Bankera and the range of services we provide is a foundational groundwork laid for further development and refinement. The upgraded Bankera is just around the corner, our plan is to gradually increase the set of features on the platform and make the entire experience as intuitive and as quick as possible.

Business accounts

While a number of neobanks in the market are focused on individual users, we have decided to broaden our services and offer a possibility to cater to corporate clients as well. Regardless if our client is running a multi-million company, a small family business or makes a living as a freelancer, we expect to be able to offer a solution that fits their needs already in the second quarter of 2020.

To offer the possibility of customization to our clients, Bankera is going to introduce three different business account models that will vary depending on the industry and the market that the company operates in. Our services will include providing dedicated company IBAN accounts, handling SEPA payments. We are also preparing for offering card acquiring services.

Companies operating in the cryptocurrency industry have experienced a number of difficulties handling fiat payments over the years. We have a deep understanding of the field; hence, we have decided to provide a unique solution designed specifically for blockchain businesses. Be it a cryptocurrency exchange, brokerage or a cryptocurrency mining farm, our ‘Crypto business’ subscription plan will offer an opportunity to such businesses to upgrade their proposition by providing numerous fiat-related services.

Debit cards

By the end of 2020, we are also aiming to start offering personal and corporate debit cards to both individual and corporate customers of Bankera. Our team is looking forward to finally being able to provide our clients with a card solution developed in our own ecosystem, not reliant on external parties.

Bankera contactless cards should prove to be the essential addition to our banking platform, as it will offer an additional and, arguably, the primary use case of our product: point-of-sale payments. Bankera is working hard to ensure that once offered its physical cards would be widely accepted in millions of shops and ATM’s worldwide. Virtual cards are also to be offered on our platform to provide an option for secure online shopping.

Bankera app

A recent study has estimated that around 3.5 billion people will own a smartphone by the end of 2020. Therefore, it is utmost important for digital companies to offer solutions that are compatible with mobile devices to remain competitive in the market. Bankera will do just that — Bankera app for Android and iOS users will be released later.

Bankera mobile app will serve as a ‘bank in your pocket’ solution. Users will be able to manage their everyday finance comfortably, track expenses, make payments or request money to be sent from their friends and family. The application will be fully synchronized with the Bankera online platform to ensure convenience for the clients who would like to use both products.

Payments acquiring

Bankera is in preparation to also offer payment acquiring services for companies looking to accept credit and debit card payments in their business. By integrating Bankera API solution with the help of our dedicated IT team, businesses will be able to accept payments from their clients and settle them in the currency of their choice.

Multi-currency support

Our team believes that the competitiveness of our product also relies on its versatility and ability to serve the needs of clients from different parts of the world. Thus, along with implementing new features, we are also planning to expand the ones already available.

For instance, we are going to support a wide selection of currencies on our platform. In addition to the already accepted Euro, we are also planning to launch support for other major currencies, such as the US dollar, British pound, and many more.

Enough about the future — Bankera online banking solution is already live! We invite you to sign up and try it yourselves.

If you are using social media platforms, feel free to share your insights with us through Bankera’s social media channels.

16 March, 2020